Welcome to Sohum Finacial Solutions

Your Path to Financial Freedom Starts with Us

Secure Your Financial Future Today

Planning objective financial advice

Risk Management

Identify, assess, and mitigate potential financial risks to safeguard your assets and ensure long-term stability.

Investment Analysis

valuate and analyze investment opportunities to optimize returns and make informed financial decisions.

Cash Flow

Monitor and manage the movement of money in and out of your finances to maintain liquidity and support growth.

About Us

We Help financial Advisors that exclusively serve

At Sohum Financial Solutions, we are committed to helping you take control of your financial future. Our in-depth financial education program is designed to equip you with the knowledge needed to make well-informed decisions that will positively impact your life and your family.

Explore the world of financial management with us, and let us guide you in building a solid financial foundation for a successful tomorrow. With the right tools and resources, the possibilities are endless.

Start your financial education journey with Sohum Financial Solutions today, and watch your confidence grow as you take charge of your financial destiny.

6 STEPS TO FINANCIAL SECURITY

Success Begins With Financial Education

Financial Literacy

- Why Financial Literacy ? Is it a must for Individual and Business owners ?

- The more we know , the better we are with best choices for our money

- Money is an important part of our life from the day in teens to End of life. Do you agree ?

- How much we earn is not important , How much you saved and most important is Your wealth has incremental Growth . Agreed ?

Family Protection

- Protection is nothing but Protection of your Hard earned Money

- What's the Most valuable asset in your household ?

- Understanding of Emotional House and Financial House

- First Thing First : Why Family Protection is the Foundation of Financial House and not the Investment

- What is DIME Formula ?

- Debt Protection

- Income protection for 10-15 years

- Mortgage Protection

- Children Education

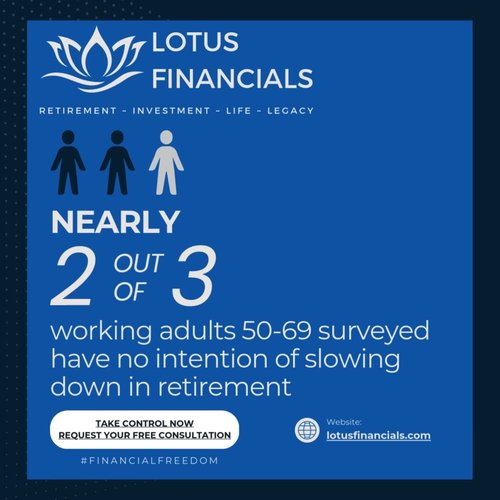

Retirement Planning

- What's Retirement ? and How to Properly Plan for Diversified and Tax Advantage Retirement ?

- When do I wish to retire ?

- How much do I need ?

- How to understand Market Risk , taxes , inflation Impact ?

- How to Manage Risk ?

- Sacrifice what ? Return of Safety or Safety of Return ?

- Tax diversification and Tax free Retirement

Life and Disability

- Does disability come with Notice?

- If disability struck , Do you lose Income and still have Financial Responsibility for Expenses

- Do you need Medical support or needs

- Who will take care ? Your money or your loved one?

- Do you know ? 66% face disability probability at age of 70 and will not have enough for Medical needs

Estate and Legacy Planning

- What is will ? Why is that a must ?

- What is Trust ? Why is that a must ?

- Why Both Will and Trust Required at an Early Age ?

- Will and Trust is not for old age and it must be updated every year without paying fees

- Documentation of your wishes , which will be accepted by law

- Who will decide the future of legacy ? Government or you ?

Financial Need analysis and Solutions

- Why Pernised FNa Required ?

- Who will Guide you ? Your CPA or Financial Advisor or your Friendly Licenced Financial Service professional

- Why do solutions and services need early actions ?

- Do you have short term and Long term Goals for your family ?

- What is a Perfect Investment Plan ?

- Book Free Immediate Consultation

Financial Plan

Empower yourself with the tools for smart financial decisions through our comprehensive education program. Explore personal finance and unlock new possibilities. Planning right for you?

Take a short quiz!

What we say our customers

Our Testimonials

Lorem ipsum dolor sit amet consectetur adipiscing elit porta, scelerisque fames dui rutrum bibendum vulputate.